Artificial Intelligence (AI) analyst David Mattin envisions a revolutionary shift in our understanding of protein function driven by AI advancements. He points to a recent breakthrough by Google DeepMind that promises to outpace human discoveries and potentially reduce the occurrence of severe diseases.

The breakthrough, known as AlphaMissense, specializes in classifying missense variants, holding the potential to be a game-changer in disease prevention. Mattin highlights AI’s role in exploring the intricate world of atoms within the human body, where hydrogen, carbon, nitrogen, and oxygen comprise approximately 99% of our composition.

“Some changes to protein function are benign. But some cause serious disease,” Mattin emphasizes in a recent statement on X (formerly Twitter), underlining the power of AI in distinguishing between these variations.

Google DeepMind’s statement on September 19th underscores the critical importance of early detection: “Missense variants are genetic mutations that can affect the function of human proteins. In some cases, they can lead to diseases such as cystic fibrosis, sickle-cell anemia, or cancer.”

AlphaMissense is positioned to assist scientists in identifying disease-causing genetic mutations and exploring innovative therapeutic avenues. The AI model’s potential is staggering, as it categorizes 89% of all 71 million possible missense variants as likely pathogenic or likely benign, whereas only 0.1% have been confirmed by human experts.

This significant disparity between AI and human findings highlights AI’s immense promise in various research fields, including molecular biology, clinical genetics, and statistical genetics. AI tools that accurately predict variant effects can expedite groundbreaking discoveries.

The statement also draws attention to the substantial costs associated with uncovering disease-causing mutations, owing to the unique nature of each protein, necessitating bespoke experiments.

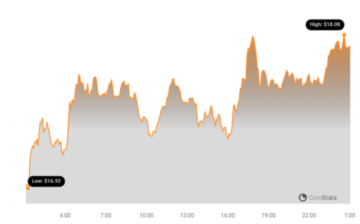

In the broader context, major investment bank Goldman Sachs shares a positive outlook on AI’s future. The bank believes in the significant potential of AI stocks, as AI companies have delivered approximately 60% year-to-date returns. This remarkable performance has sparked concerns of an AI bubble due to concentrated gains, but it also underscores the growing recognition of AI’s transformative role in various industries.

In conclusion, AI’s rapid progress in understanding protein function and identifying disease-causing mutations is a testament to its potential to revolutionize healthcare and research. The Google DeepMind breakthrough exemplifies AI’s ability to bridge the gap between human capabilities and computational power, promising a brighter future in disease prevention and treatment.

Kansas postpones its crypto-related political donation law until

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinworld.co.in/ais-transformative-impact-on-protein-function-and-disease-prevention/

- 20

- a

- ability

- accurately

- advancements

- affect

- AI

- All

- also

- an

- analyst

- and

- approximately

- ARE

- as

- associated

- attention

- avenues

- Bank

- Bankruptcy

- BE

- been

- believes

- bespoke

- between

- biology

- Bitcoin

- BitcoinWorld

- body

- breakthrough

- BRIDGE

- brighter

- broader

- bubble

- but

- by

- CAN

- cancer

- capabilities

- carbon

- cases

- Cause

- changes

- Clinical

- CO

- Companies

- composition

- concerns

- Conclusion

- confirmed

- context

- Costs

- critical

- crypto

- David

- DeepMind

- delivered

- Detection

- Deutsche Bank

- Developer

- Disease

- diseases

- donation

- draws

- driven

- due

- each

- Early

- effects

- emphasizes

- Enters

- envisions

- exemplifies

- expedite

- experiments

- experts

- Exploring

- far

- Fields

- findings

- Formerly

- function

- future

- gains

- Game Changer

- gap

- Genetics

- goldman

- Goldman Sachs

- groundbreaking

- Growing

- has

- Have

- he

- healthcare

- highlights

- holding

- HTTPS

- human

- identifying

- immense

- Impact

- importance

- in

- Including

- industries

- innovative

- Intelligence

- investment

- Is

- IT

- ITS

- known

- Law

- lead

- likely

- major

- million

- nature

- necessitating

- occurrence

- of

- on

- only

- or

- our

- Outlook

- Oxygen

- performance

- phishing

- plan

- plato

- plato data intelligence

- platodata

- platogaming

- Points

- political

- positioned

- Positive

- possible

- potential

- potentially

- power

- predict

- Prevention

- Progress

- promise

- promises

- promising

- protein

- rapid

- recent

- recognition

- reduce

- remarkable

- research

- returns

- revolutionary

- revolutionize

- role

- Rumor

- s

- Sachs

- scientists

- september

- severe

- Shares

- shift

- significant

- some

- sparked

- specializes

- Statement

- Stocks

- Strategy

- substantial

- such

- tag

- testament

- that

- The

- The Gap

- Therapeutic

- These

- they

- this

- to

- tools

- transformative

- treatment

- underscores

- understanding

- unique

- various

- wants

- where

- whereas

- with

- within

- world

- X

- zephyrnet