It seems safe to say that as the numbers grow bigger in the mobile gaming market, so too do the upsets. Markets change position rapidly, companies rise and fall, and aside from a few key mainstays the ever-changing landscape is the only constant.

But if there’s one thing that may be a titanic shift for the mobile market, that’s the question of whether China will fall from its position as the largest mobile market in the world, with chief competitor India waiting in the wings to take its place.

Niko Partners’ recently released an infographic which paints a gloomy picture for China’s mobile gaming industry than they’ve seen in years, and a much brighter one for India. As two of the largest countries in the world by population it’s only natural that in an increasingly digitised world where a smartphone may soon be in everyone’s hand, that these two titans are increasingly set to soon compete for the title of largest mobile market.

Unpacking the numbers

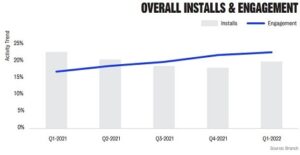

Niko Partners provides numerous key figures to support this competition. Including pointing to India becoming the fastest growing gaming market in Asia by ARPU (Average revenue per unit) as well as players and revenue. PC and mobile gamers share many of the figures, although as we previously covered in our Newzoo report on Brazil, it’s always important to note that these are not wholly separate or mutually exclusive audiences. Many PC gamers play on mobile and vice versa, with Niko Partners pointing to an overall 14.1 hours spent on mobile games specifically by self-identified gamers per week.

However, one key figure to compare is overall game revenue. Compared to China’s massive valuation of $8.2bn, India is forecast only to reach $1.4b by 2026. This indicates that we won’t see the countries in a neck and neck race there any time soon. But Niko’s report observes that gamers are increasing faster than revenue. In this respect India could very easily overtake China, after that, it’s a question of monetization, or capitalising on this enormous player base to push revenue through the roof.

Why India?

So why is India approaching China so rapidly? A major factor is far more lax regulations on what can be published and a less restrictive licensing situation. Although Indian regulators have stepped in to block games by publishers such as Krafton over dubious claims of privacy concerns around games like PUBG and BGMI (BattleGrounds Mobile India), the regulations are less opaque and rapidly changing than they are in China. Indian developers also do not face the licensing freezes that have drastically affected the mobile gaming industry in China.

This is not to say India is some sort of Wild West when it comes to mobile game development, but it’s hard to match the heavy hand that Chinese regulators have when it comes to game development. India, in many ways, is a mirror of China, a rapidly digitising country with a huge potential audience, but with fewer drawbacks to business, including firm regulations on imported foreign games.

Can China recover?

Experts have been making doom and gloom predictions about the Chinese economy as a whole for years now. However, it isn’t too strong to say that China may be facing a repeat of the sort of economic shock that hit many countries the first time Covid-19 spread. The government continues to pursue a strong ‘Zero Covid’ policy that has seen lockdowns enforced harshly, tactics that have seen mixed success as other countries have generally dropped restrictions.

Ordinarily, lockdowns have been a boon for games and other forms of media as they make other forms of entertainment unavailable or unfeasible. However, at the same time China has also been cracking down on video games for younger audiences, combatting what the government calls ‘spiritual opium’. The rapid and often unannounced nature of lockdowns and tightening restrictions also rarely gives people time to adjust or even settle employment matters, meaning they’re unlikely to want to spend time on games.

However, again, doom and gloom predictions are nothing new for the Chinese market. Positive news such as signals that the government will begin easing off licensing restrictions and that they believe they have ‘succeeded’ in their mission to curb youth video game addiction have many companies and observers hopeful the video game industry in the country can bounce back, and that the government will ease off the reins.

Looking beyond Asia and India

So are we likely to see India overtake China anytime soon? Most likely not for a few years, at least not in all factors. However, Niko Partners made a significant move by excluding China from its recent Asia Top 10 data to focus on other emerging countries in the market. They note that esports is rising in Asia, as well as the spread of 5G connectivity as key takeaways, both of which point to an increased spread of mobile share across many other countries.

Esports have been a key factor as Riot Games announced they had dropped all plans for esports outside of Asia recently. However, it should be noted that the majority of teams for their Wild Rift league are still based in China. As we noted previously though, competing esports investors such as Mobile Global esports have been making investments into India specifically, including snapping up new hires from veteran esports organisers.

In conclusion

Don’t consider this a prophecy by any means. China remains the focus of much of the mobile gaming news for Asia, as well as home to major companies such as Tencent and Netease. However, it’s also an important reminder that no-one is untouchable, especially in a world as ever-changing and fragile as media and gaming.