Bitcoin (BTC) price is on the brink of breaching the $50,000 threshold as bullish momentum continues to build up amid substantial inflows into spot Bitcoin exchange-traded funds (ETFs).

According to data from BitMEX Research, spot Bitcoin ETF net inflows surged from around $68 million at the start of the week to $541 million on Friday, marking the largest influx since the second trading day.

Bitcoin ETF Flow – 9th Feb

All data out. Strong day at $541.5m of net inflow

Invesco had an outflow, the first non-GBTC product to have an outflow day pic.twitter.com/UCFDVAaKD3

— BitMEX Research (@BitMEXResearch) February 10, 2024

BlackRock still leads the pack, ending the week with over $250 million in net inflows.

Fidelity and ARK Invest are not far behind, with around $188 million and $136 million in net inflows, respectively.

The Grayscale ETF experienced a record low, with over $51 million in a single-day net outflow.

See Also: Bitcoin Price Surged Past $47,000 Mark: Here Are The 3 Key Reasons

Fund flows are a vital indicator of investor sentiment and behavior. In general, when investors pour money into funds, it indicates optimism about future profits.

On the other hand, when investors withdraw their money, it often signals increasing caution or concern. Strong inflows can drive up prices as increased demand attracts more investors.

This can lead to a positive feedback loop, where rising prices draw in even more investment, further boosting prices.

Spot Bitcoin ETFs have now amassed over $10 billion in assets under management, with BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund leading the charge, each managing over $3 billion in BTC, as reported by HODL15Capital.

The new spot #Bitcoin ETFs hold more $BTC than @saylor ‘s $MSTR

The 9 new ETFs purchased 216,309 Bitcoin (worth $10.3 Billion!!!) in just 20 days 💥$IBIT $FBTC $ARKB $BITB $BRRR $BTCO $HODL $EZBC pic.twitter.com/i8amhqCjWF

— HODL15Capital 🇺🇸 (@HODL15Capital) February 11, 2024

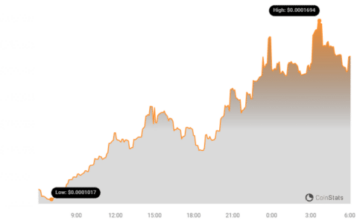

Bitcoin’s price moved in the same direction with strong ETF inflows and performance.

On February 9, the week’s final trading day, the price soared to $48,200, up almost 6% in seven days.

This positive trajectory suggests that Bitcoin’s push towards the $50,000 mark is increasingly viable in the near future with strong, persistent spot Bitcoin ETF performance.

Other factors should also be considered, such as the anticipated pre-halving rally, the Fed’s monetary policy, and supply/demand dynamics.

So far, all available indicators suggest that Bitcoin is at the start of a bull cycle. The expected $50,000 mark may soon become another support level for Bitcoin to hit a new milestone.

See Also: Best Cryptos To Buy Today February 9 – BONK, BEAM, SUI

Despite the optimistic outlook, Bitcoin is susceptible to price fluctuations and potential profit-taking activities.

Investors should conduct comprehensive research and exercise caution before making any investment decisions.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Study: 84% Anticipate Bitcoin to Peak Post-Halving; Robust

Surpassing Expectations, NuggetRush Hits Presale Milestones As Investors

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinworld.co.in/bitcoin-price-eyes-50000-target-amid-strong-etf-inflows/

- $3

- 000

- 10

- 11

- 20

- 200

- 216

- 9

- 9th

- a

- About

- activities

- advice

- All

- almost

- also

- amid

- an

- and

- Another

- anticipate

- anticipated

- any

- ARE

- Ark

- around

- as

- Assets

- At

- attracts

- available

- based

- BE

- Beam

- become

- before

- behavior

- behind

- Billion

- Bitcoin

- BitcoinWorld

- BitMEX

- bonk

- boosting

- brink

- BTC

- build

- bull

- Bullish

- buy

- by

- calls

- CAN

- category

- caution

- charge

- CO

- comprehensive

- concern

- conduct

- considered

- consultation

- continues

- could

- cryptos

- Custody

- cycle

- data

- day

- days

- decisions

- Demand

- digital

- direction

- Dollar

- draw

- drive

- dynamics

- each

- ending

- ETF

- ETFs

- even

- Exercise

- expectations

- expected

- experienced

- eyes

- Factors

- far

- February

- feedback

- Final

- financial

- financial advice

- First

- flow

- flows

- fluctuations

- For

- Friday

- from

- fund

- funds

- further

- future

- General

- Grayscale

- had

- hand

- Have

- here

- HIT

- hits

- hold

- holds

- HTTPS

- in

- Inc.

- increased

- increasing

- increasingly

- Independent

- indicates

- indicator

- indicators

- inflows

- influx

- information

- into

- invest

- investment

- Investments

- investor

- Investors

- Is

- IT

- just

- Key

- largest

- lead

- leading

- leads

- Level

- liability

- Low

- made

- Making

- management

- managing

- mark

- marking

- May

- milestone

- Milestones

- million

- Momentum

- monetary

- monetary policy

- money

- more

- moved

- Near

- net

- New

- no

- not

- now

- of

- often

- on

- optimism

- optimistic

- or

- Origin

- Other

- out

- Outlook

- over

- pack

- page

- Past

- peak

- performance

- plato

- plato data intelligence

- platodata

- platogaming

- policy

- Positive

- potential

- presale

- president

- price

- prices

- Product

- professional

- provided

- purchased

- push

- qualified

- rally

- recommend

- record

- reported

- research

- rising

- same

- Satoshi

- second

- sell

- sentiment

- seven

- should

- signals

- since

- Soon

- Spot

- start

- still

- strong

- strongly

- subsidiary

- substantial

- such

- suggest

- suggests

- support

- support level

- susceptible

- tag

- Target

- than

- that

- The

- their

- this

- to

- Today

- towards

- Trading

- trajectory

- true

- Trust

- under

- up

- us

- viable

- vital

- we

- week

- when

- where

- wise

- with

- withdraw

- worth

- zephyrnet