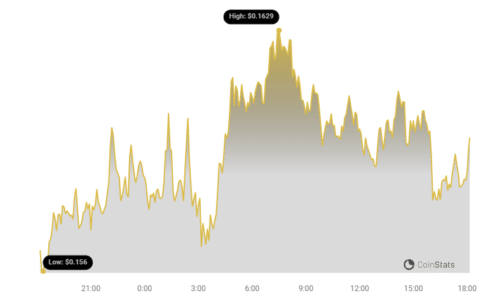

Dogecoin (DOGE) price is attempting a recovery wave above the $0.150 resistance zone against the US Dollar. DOGE could struggle to clear the $0.170 resistance zone.

- DOGE started a recovery wave from the $0.1280 support zone against the US dollar.

- The price is trading above the $0.1500 level and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance at $0.170 on the 4-hour chart of the DOGE/USD pair (data source from Kraken).

- The price must settle above $0.170 to move into a positive zone and start a fresh surge.

Dogecoin Price Faces Hurdles

After a major decline, Dogecoin price found support at $0.1280.

A low was formed at $0.1283 and DOGE started a decent recovery wave, like Bitcoin and Ethereum. There was a move above the $0.1350 and $0.140 resistance levels.

The price climbed above the 23.6% Fib retracement level of the downward wave from the $0.2093 swing high to the $0.1283 low.

However, the bears are still active and protecting more gains. There is also a key bearish trend line forming with resistance at $0.170 on the 4-hour chart of the DOGE/USD pair.

Dogecoin is also below the $0.1650 level and the 100 simple moving average (4 hours).

See Also: Cardano (ADA) Price Analysis: Bulls Aim Steady Increase

On the upside, the price is facing resistance near the $0.1690 level or the 50% Fib retracement level of the downward wave from the $0.2093 swing high to the $0.1283 low.

The next major resistance is near the $0.170 level. A close above the $0.170 resistance might send the price toward the $0.1880 resistance.

The next major resistance is near $0.200. Any more gains might send the price toward the $0.220 level.

Another Decline in DOGE?

If DOGE’s price fails to gain pace above the $0.170 level, it could start another decline. Initial support on the downside is near the $0.1525 level.

The next major support is near the $0.1475 level. If there is a downside break below the $0.1750 support, the price could decline further.

In the stated case, the price might decline toward the $0.1280 level.

Technical Indicators

- 4 Hours MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

- 4 Hours RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

- Major Support Levels – $0.1525, $0.1475 and $0.1280.

- Major Resistance Levels – $0.1690, $0.1700, and $0.200.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

PayPal Proposed ‘Cryptoeconomic’ Rewards For Sustainable Bitcoin Miners

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinworld.co.in/doge-price-prediction-dogecoin-recovery-could-stall-at-0-170/

- 100

- 12

- 140

- 150

- 1500

- 1650

- 170

- 200

- 220

- 23

- 362

- 50

- a

- above

- active

- ADA

- advice

- Against

- aim

- also

- analysis

- and

- Another

- any

- app

- ARE

- as

- At

- average

- based

- bearish

- Bears

- before

- below

- Bitcoin

- Bitcoin miners

- BitcoinWorld

- break

- Bullish

- Bulls

- care

- case

- category

- chart

- clear

- close

- CO

- consultation

- could

- data

- decisions

- Doge

- Dogecoin

- Dollar

- downside

- downward

- ethereum

- exposed

- faces

- facing

- fails

- far

- Features

- For

- formed

- found

- fresh

- from

- further

- gain

- gaining

- gains

- High

- holds

- hours

- HTTPS

- if

- in

- Independent

- index

- information

- initial

- into

- investment

- Investments

- Is

- IT

- Key

- Kraken

- Level

- levels

- liability

- like

- Line

- Low

- made

- major

- Making

- meme

- might

- Miners

- Momentum

- more

- move

- moving

- must

- Near

- Next

- no

- not

- now

- of

- on

- or

- pace

- page

- pair

- payments

- platform

- plato

- plato data intelligence

- platodata

- platogaming

- Positive

- prediction

- presale

- price

- Price Analysis

- Price Prediction

- professional

- proposed

- protecting

- provided

- qualified

- recommend

- recovery

- relative

- released

- research

- resistance

- revenue

- Rewards

- rsi

- send

- settle

- Simple

- Solana

- source

- start

- started

- stated

- steady

- still

- strength

- strongly

- struggle

- support

- surge

- sustainable

- Swing

- tag

- The

- there

- this

- to

- toward

- Trading

- trend

- us

- was

- Wave

- we

- with

- X

- zephyrnet

- zone