The company’s exposure to Silicon Valley Bank was discussed by Ripple CEO Brad Garlinghouse on Twitter on March 12. He also assured his followers that Ripple was stable. Garlinghouse stated that although Ripple has exposure to SVB, “we expect NO impact to our day-to-day business, and already held a majority of our USD with a broader network of bank partners,”

The purpose of his succinct tweet thread was to comfort users. He tweeted, “Be assured, Ripple is still in a healthy financial position. The amount of cash that the corporation has in SVB was not disclosed by Garlinghouse. The message received a favorable response from many Twitter users who were following the topic.

One person said, “I never questioned you or @Ripple to have conducted sufficient risk management. Although it’s unclear whether the Garlinghouse tweet was what Ripple Chief Technology Officer David Schwartz had in mind when he said on March 11 that the business will issue a statement regarding its Ripple exposure “shortly,” he had made that commitment.

A few hours later, the Federal Reserve declared it had started a $25 billion funding program to help banks with liquidity amid difficult financial circumstances.

The Federal Reserve announced that starting on Monday, March 13, all Silicon Valley Bank depositors would have access to all of their funds.

“No losses related to Silicon Valley Bank’s resolution will be paid by the taxpayer,” it continued.

On March 10, Schwartz said, “I still don’t get how a run on a bank can make it insolvent. If the bank was previously solvent, it signifies that its assets are more than its liabilities. As their 10-year treasuries aged, they most likely would have become solvent against. Yet a run prevented them from having that chance.

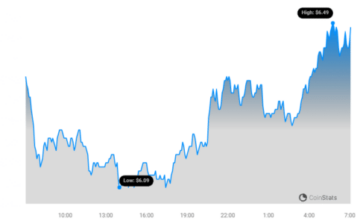

The price of Ripple’s XRP fell from a high of $0.40 on March 9 to a low of $0.35 on March 12 before rebounding. This was contrary to market trends.

The XRP cryptocurrency is the subject of a legal dispute between Ripple and the US Securities and Exchange Commission, yet a firm executive referred to 2022 as a “historic year of business and client development” for the organization. Garlinghouse predicted that the matter will be concluded in June in a statement he made in January.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://bitcoinworld.co.in/ripple-ceo-assures-strong-financial-position-despite-svb-collapse/

- 11

- 2022

- 9

- a

- access

- Against

- aged

- All

- Although

- amount

- announced

- ARE

- as

- Assets

- assured

- assures

- ato

- Authority

- Bank

- Banks

- BE

- become

- before

- between

- Billion

- BitcoinWorld

- broader

- business

- by

- CAN

- Cash

- ceo

- chance

- chief

- chief technology officer

- circumstances

- CO

- collapse

- commission

- commitment

- company's

- conducted

- continued

- CORPORATION

- crypto

- cryptocurrency

- curve

- David

- day-to-day

- declared

- despite

- difficult

- discussed

- Dispute

- exchange

- executive

- expect

- exposure

- Federal

- federal reserve

- finance

- financial

- Firm

- followers

- Following

- For

- from

- funding

- funds

- Have

- having

- help

- High

- hold

- hours

- How

- HTTPS

- Impact

- in

- Is

- IT

- ITS

- January

- Legal

- liabilities

- Liquidity

- Low

- Majority

- make

- management

- March

- March 13

- Market

- market trends

- matter

- Message

- Monday

- more

- network

- news

- of

- Officer

- on

- Operations

- organization.

- paid

- partners

- plato

- plato data intelligence

- platodata

- platogaming

- position

- predicted

- previously

- price

- Program

- purpose

- received

- Regarding

- RELATED

- resolution

- response

- responsible

- Ripple

- Risk

- risk management

- Run

- s

- Said

- Securities

- Securities and Exchange Commission

- sees

- Silicon

- Silicon Valley

- silicon valley bank

- started

- Starting

- Statement

- still

- subject

- sufficient

- SushiSwap

- tax

- Technology

- that

- The

- their

- Them

- to

- topic

- Trends

- tweet

- u.s.

- unclear

- us

- USD

- USDC

- users

- Valley

- What

- WHO

- will

- with

- would

- xrp

- year

- zephyrnet