As the world continues to embrace the inevitable intersection of technology and finance, there’s a surging interest in the realm of central bank digital currencies (CBDC). I know like many of you, as an enthusiast I closely monitor global advancements in gaming, crypto, web3, and blockchain. So, when the Reserve Bank of Australia (RBA) released their recent findings on a CBDC pilot program, it rightfully piqued my interest. Here’s an in-depth review of the matter, putting a spotlight on its potential impacts for the G1 audience.

The Pilot Program: An Overview

The RBA, in collaboration with the Digital Finance Cooperative Research Centre (DFCRC), embarked on an intriguing journey into the world of CBDCs. Their pilot program centered around the exploration of an e-AUD – a potential digital version of the Australian dollar. Their objectives were clear: to evaluate the feasibility, benefits, and challenges of integrating a CBDC into Australia’s digital economy.

The Big Takeaways

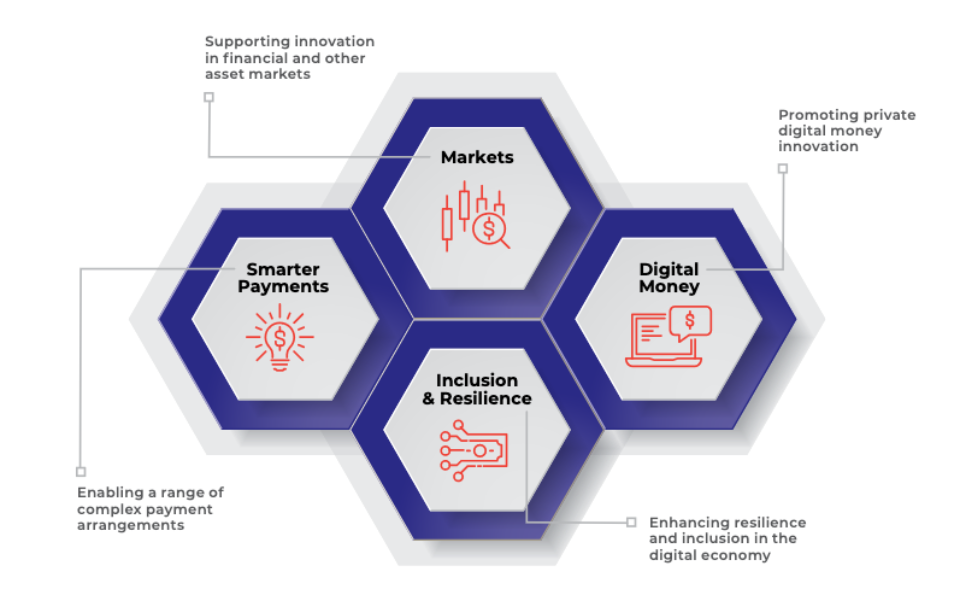

- Utility and Versatility: One of the paramount findings is the e-AUD’s utility in four crucial areas: complex payments, asset tokenization, financial innovation in debt securities markets, and fortifying resilience and inclusivity in the broader digital domain. Gamers, developers, and crypto-enthusiasts should note the ability of CBDCs to enable smarter payments, allowing for intricate arrangements that aren’t supported by current payment infrastructures.

- Atomic Settlements & Programmability: From the feedback of the 16 firms that engaged in the pilot, the magic of “atomic settlements” emerged—a form of transaction settlement that is simultaneous and instant. For those involved in the gaming and crypto sectors, this could mean revolutionary improvements in micro-transactions, in-game purchases, and real-time trade. Furthermore, the programmability feature of CBDCs was highlighted as a significant game-changer, potentially revolutionizing complex business processes.

- Legal & Regulatory Hurdles: As with all innovative financial ventures, CBDCs aren’t without their challenges. The pilot was unique in that it acted as a legitimate claim on the RBA, sparking concerns over its legal status and the regulatory treatments surrounding it. For potential stakeholders in the gaming and blockchain sectors, these legal ambiguities could influence the speed of adoption and integration into their ecosystems.

- Potential Alternatives: The report did present a balanced view, suggesting that many advantages of CBDCs could also be achieved through other means. For example, the utilization of private tokenized bank deposits or asset-backed stablecoins. This acknowledgement suggests that while CBDCs have potential, they might not be the only future.

The Voices Behind the Project

Brad Jones, Assistant Governor (Financial System) at the RBA, emphasized the invaluable insights obtained on how a CBDC could be a catalyst for the Australian financial system and the broader economy. He accentuated the importance of cooperation between the financial industry and policymakers, aiming to leverage innovations in digital finance.

Furthermore, Dr. Andreas Furche, CEO of DFCRC, reiterated the continuous evolution of financial innovation, suggesting a robust synergy between central banks and industry experts to harness CBDCs’ potential.

My Quick Synthesis

CBDCs are undeniably making waves in the digital finance landscape. The RBA’s pilot program unveils both the immense potential and intricate challenges these currencies pose. For the gaming, crypto, and blockchain communities, the introduction of a CBDC in Australia (and potentially globally) could herald a new era of transactional efficiency, security, and innovation. However, the path is laden with regulatory, legal, and technical obstacles that need to be addressed.

For now, the RBA’s pilot program provides a valuable stepping stone, indicating the direction in which the wind of financial innovation is blowing. As the narrative around CBDCs unfolds, be sure to watch this space closely as I am. For those intrigued by the details and specifics, delve into the official Australian CBDC Pilot Project on the RBA website, or visit the CBDC pilot project site.

Note: This article is informational, and G1 does not vouch for any content or product mentioned. Readers are urged to conduct their own research before making decisions linked to the mentioned company. This article should not be interpreted as investment guidance.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://g1.gg/news/australias-push-into-cbdc/

- 16

- a

- ability

- achieved

- Adoption

- advancements

- advantages

- Aiming

- All

- Allowing

- also

- am

- an

- and

- any

- ARE

- areas

- around

- article

- as

- asset

- Asset Tokenization

- Assistant

- At

- audience

- Australia

- Bank

- bank deposits

- Banks

- BE

- before

- behind

- benefits

- between

- BIG

- blockchain

- blowing

- both

- broader

- business

- business processes

- by

- Catalyst

- CBDC

- CBDCs

- central

- Central Bank

- central bank digital currencies

- Central Banks

- Centre

- ceo

- challenges

- claim

- clear

- closely

- collaboration

- COM

- Communities

- company

- complex

- concerns

- conduct

- content

- continues

- continuous

- cooperation

- cooperative

- could

- crucial

- crypto

- currencies

- Current

- Debt

- decisions

- deposits

- details

- developers

- DID

- digital

- digital currencies

- digital economy

- Digital Finance

- direction

- does

- Dollar

- domain

- dr

- economy

- Ecosystems

- efficiency

- embarked

- embrace

- emphasized

- enable

- engaged

- era

- Evaluate

- evolution

- Example

- experts

- exploration

- Feature

- feedback

- finance

- financial

- financial innovation

- financial system

- findings

- firms

- For

- form

- four

- from

- furthermore

- future

- Game Changer

- Gamers

- Gaming

- Global

- globally

- Governor

- guidance

- harness

- Have

- he

- High

- Highlighted

- How

- however

- HTML

- HTTPS

- i

- immense

- Impacts

- importance

- improvements

- in

- in-game

- Including

- Inclusivity

- industry

- industry experts

- inevitable

- influence

- informational

- infrastructures

- Innovation

- innovations

- innovative

- insights

- instant

- integrating

- integration

- interest

- intersection

- into

- intriguing

- introduction

- invaluable

- investment

- involved

- Is

- IT

- ITS

- jones

- journey

- know

- landscape

- Legal

- legitimate

- Leverage

- like

- linked

- Magic

- main

- Making

- many

- Markets

- matter

- mean

- means

- might

- Monitor

- my

- narrative

- need

- New

- not

- now

- objectives

- obstacles

- obtained

- of

- official

- on

- One

- only

- or

- Other

- over

- own

- Paramount

- path

- payment

- payments

- pilot

- plato

- plato data intelligence

- platodata

- platogaming

- policymakers

- pose

- potential

- potentially

- present

- private

- processes

- Product

- Program

- project

- provides

- purchases

- push

- putting

- quick

- readers

- real-time

- realm

- recent

- regulatory

- released

- report

- research

- reserve

- resilience

- review

- revolutionary

- revolutionizing

- robust

- Sectors

- Securities

- security

- settlement

- settlements

- should

- significant

- simultaneous

- smarter

- So

- some

- Space

- specifics

- speed

- Spotlight

- Stablecoins

- stakeholders

- Status

- Stone

- suggests

- Supported

- sure

- surging

- surrounding

- synergy

- system

- Technical

- Technology

- that

- The

- the world

- their

- These

- they

- this

- those

- Through

- to

- Tokenization

- tokenized

- trade

- transaction

- transactional

- unique

- unveils

- utility

- valuable

- Ventures

- version

- View

- Visit

- VOICES

- was

- Watch

- waves

- Web3

- were

- when

- while

- wind

- with

- without

- world

- you

- zephyrnet