Remember back in April last year, when the UK government decided it was going to show off the “forward-looking approach” that it was “determined to take toward cryptoassets in the UK” by directing the Royal Mint to create a state-backed “NFT For Britain” (opens in new tab)? You might not, it was several prime ministers ago. Regardless, those plans have now been ditched.

Well, kind of. Economic Secretary Andrew Griffith said yesterday (opens in new tab) that “the Royal Mint is not proceeding with the launch of a Non-Fungible Token” after consulting with His Majesty’s Treasury, but noted that the proposal would be kept “under review”. You know, just in case NFTs suddenly become a really good idea.

Griffith didn’t say what, in particular, led the Treasury and Royal Mint to jettison the national NFT idea, but that hasn’t stopped other members of the government from speculating. “We have not yet seen a lot of evidence that our constituents should be putting their money in these speculative tokens unless they are prepared to lose all their money,” chair of the Treasury Select Committee Harriet Baldwin told the BBC (opens in new tab), “So perhaps that is why the Royal Mint has made this decision in conjunction with the Treasury”.

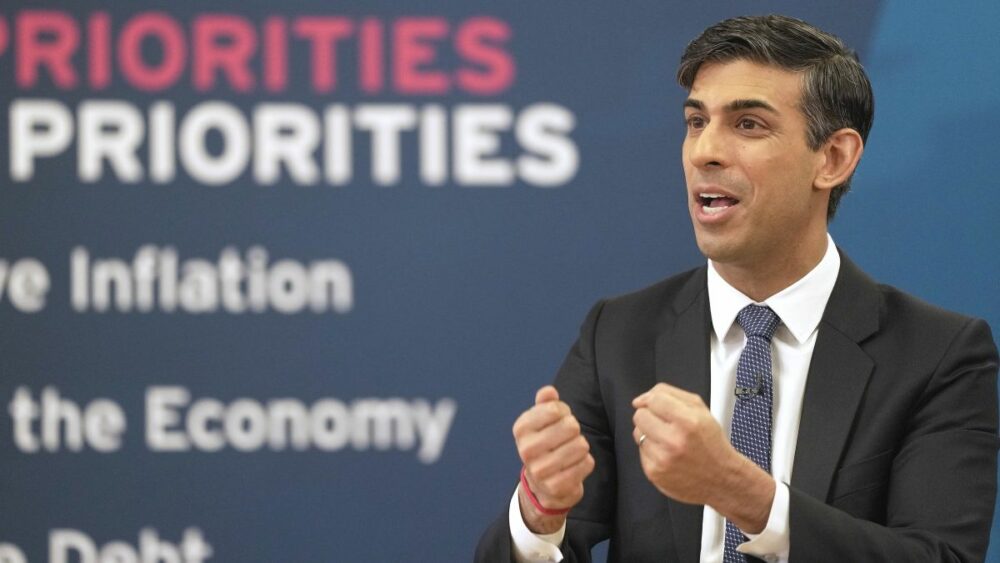

Perhaps, indeed. Whatever the reason, we probably shouldn’t take this as a sign that Britain’s latest prime minister is a crypto-sceptic. In fact, current PM Rishi Sunak was the one who ordered the NFT’s creation back when he was chancellor under Boris Johnson in 2022 and is on-record as a strong supporter of crypto (opens in new tab) and blockchain tech. It may just be the case that the government isn’t keen on tooting its crypto horn too loudly with the historic collapse of FTX (opens in new tab) so fresh in everyone’s memories.

But fear not, crypto stans, the UK has multiple irons in the blockchain fire right now, including a public consultation on the creation of a “digital pound,” (opens in new tab) which will conclude this June. If all goes well (or not, depending on your perspective) we could see the introduction of “a new form of digital money for use by households and businesses for their everyday payments needs” in the UK: A Central Bank Digital Currency, much like the ones already being pioneered in China, Canada, and several other countries (opens in new tab) around the world. The future is now, whether we like it or not.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.pcgamer.com/nft-for-britain-idea-proves-too-stupid-even-for-uk-government

- 2022

- a

- All

- Andrew

- approach

- April

- ARE

- around

- as

- Bank

- bbc

- BE

- become

- blockchain

- boris johnson

- businesses

- by

- Canada

- case

- central

- Central Bank

- Chancellor

- CNBC

- CO

- collapse

- conclude

- consulting

- could

- create

- creation

- crypto

- Currency

- Current

- decided

- decision

- digital

- digital currency

- Digital Money

- everyone

- Evidence

- Fear

- Fire

- For

- form

- fresh

- from

- future

- Gaming

- going

- good

- Government

- Have

- HTML

- HTTPS

- idea

- in

- Including

- introduction

- Is

- IT

- ITS

- Johnson

- jpg

- kind

- last

- latest

- launch

- Led

- like

- lose

- May

- Members

- might

- ministers

- Mint

- money

- multiple

- National

- needs

- New

- NFT

- NFTs

- non-fungible

- non-fungible token

- noted

- of

- on

- One

- opens

- Other

- Parliament

- particular

- payments

- perspective

- pioneered

- plans

- plato

- plato data intelligence

- platodata

- platogaming

- prepared

- Prime Minister

- probably

- proposal

- proves

- public

- putting

- regardless

- review

- right

- rishi sunak

- royal

- s

- Said

- secretary

- several

- should

- show

- So

- strong

- supporter

- TAB

- Take

- tech

- that

- The

- The Future

- the NFT

- the world

- their

- These

- to

- token

- Tokens

- treasury

- Uk

- UK government

- under

- use

- well

- What

- WHO

- will

- with

- world

- would

- year

- zephyrnet