Written by Drew Borland of SportSource Analytics

In a previous article, “Do Sports Betting Trends Have Value”, the moral of the story was that raw win/loss ATS trends do not have value and simply are not predictive. Winning and losing a bet is a binary proposition that is not subject to gradation. Evaluating trends and history through those binary lenses will rarely ever reveal any substantial value. So how should we look at history, on-field performance, and trends for value?

Mirroring The Markets

First, let’s understand the approach. Looking at teams and their performance is very similar to looking at stocks. There are two fundamental forces that move stocks up and down.

- Recent Company Performance. These are the balance sheets and quarterly reports that provide a clear picture of how a company is performing. When earnings reports are released (good, bad, or expected), you can rely on stock prices to move.

- Market Factors. Sometimes stocks go up and down based on factors like interest rates, liquidity, performance of other stocks in the sector, competition, and perception (hype, rumors, buzz, trendiness, etc).

Place your football bets at Fanduel.com/BetTheBoard this season and start with a RISK FREE $1,000

Deploying Financial Principles

In sports betting, the Recent Company Performance is what sharp bettors analyze and focus on before investing. They view the advanced box scores and metrics like quarterly reports. They have an understanding of the key performance indicators (KPIs) that are indicators of future performance. Casual bettors are looking at top line performance (wins, losses, points, basic trends) rather than understanding underlying performance implications. Becoming a bettor with an edge takes a lot of time and resources (data), which most people (the public) just can’t access.

Importance of Market Factors

Stock market values are based on a continuum determined by investment interest. In sports betting there is no continuum. Stock values (the teams you can bet on) are repeatedly reset by oddsmakers. Each new line for a team is an IPO (initial public offering). Market Factors in sports betting becomes the oddsmakers setting appropriate IPO values for teams. Bettors (investors) will then bet on or against that valuation. This is where we get back to trends. They do matter when assessing Market Factors. However, they are extremely subject to gradation. They should not be viewed as binary. What we should be looking at is how well oddsmakers do setting the market.

Subscribe and Listen to Bet the Board’s NFL and College Football Weekly Previews

Follow Bet The Board on Twitter ?

@BetTheBoardPod – twitter.com/BetTheBoardPod

Follow the Hosts ?

@ToddFuhrman – twitter.com/ToddFuhrman

@Payneinsider – twitter.com/PayneInsider

Isolating Opportunity

Oddsmakers are very good setting lines at a macro level. They employ more sophistication than the average bettor and it’s not even close. If you average-out their lines over a large enough sample size, it’s always 48% to 52%. At a micro level (the team level), you can find undervalued and overvalued teams once the market results start posting.

Now that we are just beyond the quarter pole of the college football season, we can start to look at how the market setters are doing with all 130 FBS teams.

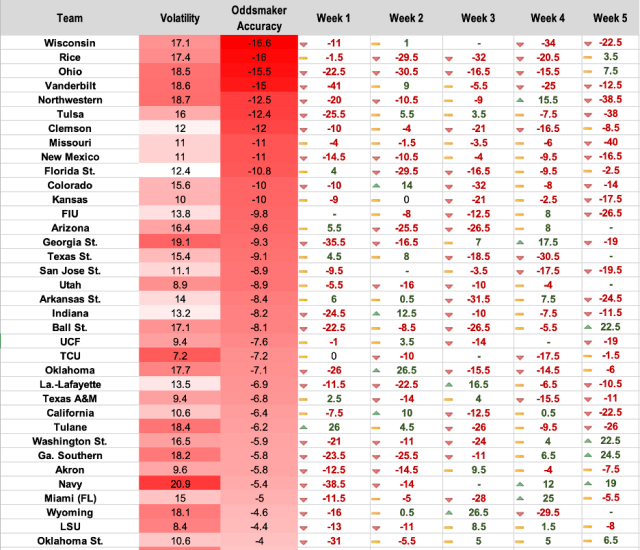

In the following chart we are going to take a look at teams through a different lens. We can evaluate three main areas; live volatility, oddsmaker accuracy, and weekly results.

- Team Volatility is the average absolute distance (regardless of plus/minus) a team is performing relative to the spread.

- Oddsmaker Accuracy is the average performance of the team relative to the spread.

- Weekly Results are week-by-week breakdowns of how the team is performing relative to the spread. If it is negative, they finished that many points from the closing line (did not cover). If it is positive, they exceeded the line by that many points (covered).

This single chart gives you a unique perspective into the team’s priced correctly compared to those schools that are not.

The Takeaway

Clearly, there are teams that oddsmakers are consistently struggling to evaluate. There are also other teams all over the map on both sides of the lines. On the flip side, there are several teams that oddsmakers are forecasting exceptionally.

In the next article (Part 2), we’ll dive deeper into interpreting this chart and understanding how the odds market values teams. This background will help expand on ways to further assess value, avoid pitfalls, and find meaningful betting opportunities week-over-week.